US 2020 Presidential Election Reaction – Biden wins election, what’s next?

( 5 min. )

- Go back to blog home

- Latest

Joe Biden has won this year’s US presidential election, but how has the currency market reacted and what does his victory mean for US policy?

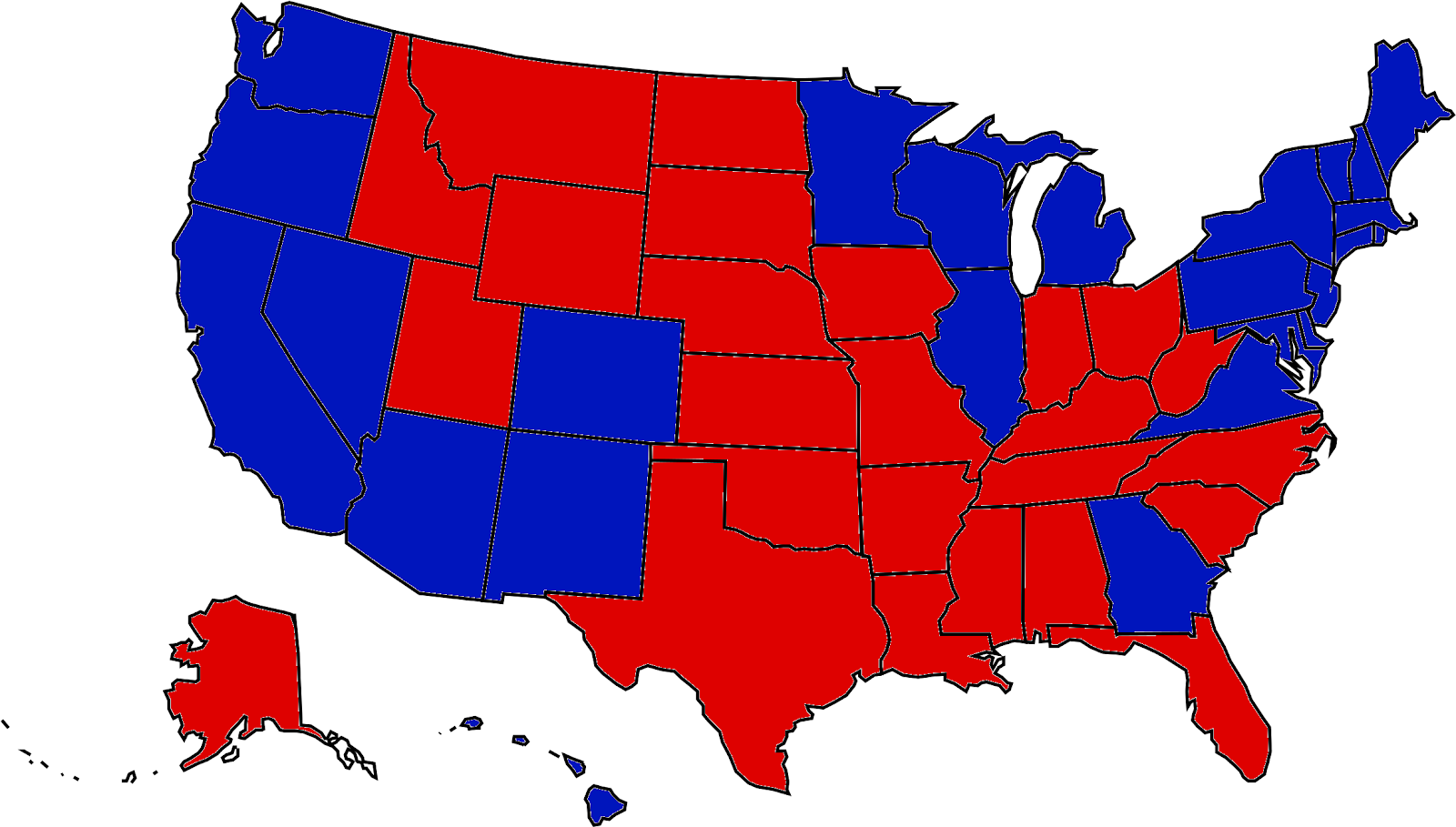

Figure 1: US 2020 Presidential Election Results Map (as of 16/11/20)

Source: Ebury/BBC Date: 16/11/2020

How have financial markets reacted to Biden’s win?

Markets had a case of deja vu on the night of the election, as early results showed that Trump had once again outperformed the opinion polls – as was the case at the 2016 election. The safe-haven US dollar initially strengthened on the prospect of a close race after President Trump won in a handful of battleground states, notably Florida, Texas, Ohio and Iowa. Bookmaker odds had Trump as clear favourite at one stage overnight on Wednesday – as high as 80% during the early hours local time.

It became increasingly clear, however, that Biden was heading for victory even with a handful of states still to declare. An added complication relative to previous elections was the high influx of postal voting brought about by the COVID-19 pandemic. Approximately 100 million Americans are said to have voted by mail this year of the record 160 million or so that voted overall – considerably higher than the 20% that did so four years ago. A feature of these ballots is that the majority of mail-in votes were cast by Democrats, with Republicans far more likely to have attended the polls in person. Financial markets, therefore, began pricing in a Biden victory relatively early on Wednesday morning, even when the official results showed a near dead heat in many of the key swing states and news outlets were cautious in declaring a winner.

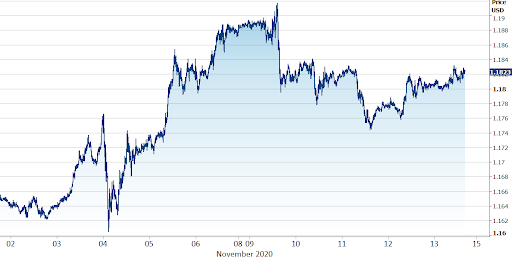

As it became apparent that Biden was on course to win, investors began ditching the safe-haven dollar and favouring risky assets. The main EUR/USD pair rallied by over 2% in the few days following election night, briefly rising back above the 1.19 level earlier this week (Figure 2). Higher risk major currencies have also been buoyed, notably the Australian and New Zealand dollars and the Norwegian krone, with the safe-haven Japanese yen and Swiss franc the two worst performers over the post-election period.

As we mentioned in our election preview report, a Biden presidency is perceived as a positive for risk assets, given the higher likelihood of a larger fiscal stimulus programme under the Democrats and decreased trade uncertainty.

Figure 2: EUR/USD (November 2020)

Source: Refinitiv Date: 13/11/2020

Emerging market currencies have also rallied, with notable moves higher in the Mexican peso and Chinese yuan, two of the countries thought most likely to suffer from a continuation of Trump’s protectionist policies. The MSCI emerging market currency index is currently trading approximately 1.5% higher for the month and is now around its strongest position since May 2018 (Figure 3). Emerging market currencies were given a further leg up by last Monday’s positive news regarding progress towards a COVID-19 vaccine.

Figure 3: MSCI EM Currency Index (November ‘19 – November ‘20)

Source: Refinitiv Datastream Date: 13/11/2020

How have financial markets reacted?

In other financial markets, we have seen a sharp move higher in equity since the election, with the S&P 500 index rising to record highs (Figure 4). Government bond yields reacted in a different fashion, falling on election night as the vote showed no clear winner (the US 10-year Treasury yield declined by around 18 basis points to 0.72% at one stage), although this has since reversed. Again, these moves have been partly a consequence of Biden’s victory and the positive vaccine news from Pfizer and BioNTech earlier regarding a 90% effectiveness of the vaccine the companies are developing.

Figure 4: S&P 500 Index (November 2020)

Source: Refinitiv Date: 13/11/2020

Will Trump’s legal challenge impact the FX market?

As we noted in our preview report, we thought that a knife-edge vote with Trump contesting the outcome was one of the big uncertainties heading into the election. We think that Biden’s advantage is now comfortable enough that markets would largely brush aside any legal contest from Trump, and see it as more of a desperate attempt to cling to power than a legitimate challenge.

The Trump campaign has so far refused to accept defeat and is challenging vote counts at the state level, which could then be escalated to the Supreme Court. Financial markets have, however, so far appeared largely unflustered by the prospect of a Trump legal challenge. Biden’s crucial win in Pennsylvania, in particular, means that Trump now has a much higher mountain to climb than Al Gore did when he challenged the outcome of the 2000 election. We expect this to ultimately fail, with any correction in risk sentiment linked to the election likely to be relatively minor from here. This view is supported by the growing chorus among Republican politicians calling for Trump to step aside and the implausibility of Trump’s legal challenges.

What does the Congress vote mean for Biden’s presidency?

Biden may not have full control of Congress once his term as President begins in January, at least for the first two years of his administration. While the Democrats were able to maintain control of the US House of Representatives, they have fallen short in winning an outright majority in the Senate and achieving a so-called ‘blue wave’.

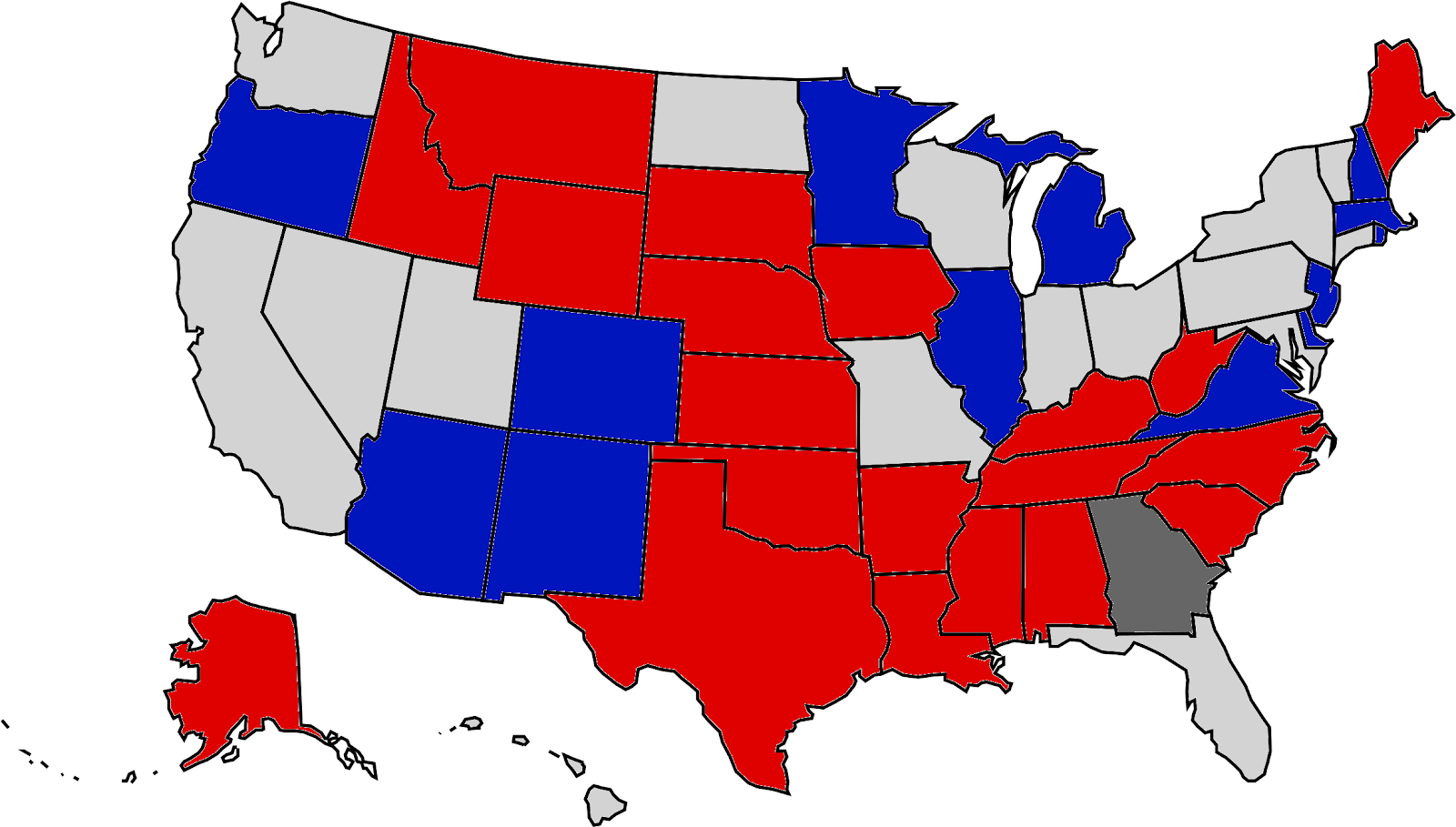

Following the reelection of Dan Sullivan in Alaska on Wednesday, the Republicans have obtained 50 seats in the Senate, one short of a majority, versus 48 for the Democrats. Two run-off elections in the historically red Georgia on 5th January will therefore decide who controls the Senate, given that no candidate obtained the 50% share of the votes required in either race. Were one or both of the seats to go to the Republicans, then Congress would be split. By contrast, a win for the Democrats in both elections would ensure a blue wave, given that Vice President-elect Kamala Harris would have authority to break the tie.

The votes themselves are too close to call at this stage. In one, the Republicans edged last week’s vote by less than two percentage points (49.7% vs. 48%), while in the other this gap stands at only one percentage point once the votes of all candidates for each party are tallied up (49.4% vs. 48.4%). An advantage for the Republicans is that they have historically gained ground in run-off elections in Georgia, having done so on seven occasions in the previous eight dating back to 1992 and in each of the past five elections since 1998. There is also a possibility that a greater percentage of Democrats in the state may simply fail to vote in the run-offs, already safe in the knowledge that Biden has won the presidency.

Figure 5: US 2020 Senate Election Results Map (as of 16/11/20)

Source: Ebury/ABC News Date: 16/11/2020

Why are the runoff elections in Georgia important for the FX market?

The run-off votes in Georgia at the beginning of the year will take on an unusual amount of significance and will undoubtedly be closely watched by financial markets. A double-win for the Democrats that gives them full control of Congress would grant Biden a much better chance of passing legislative changes during his first two years as President. This would allow him to force through more substantial fiscal stimulus designed to protect the US economy from the COVID-19 pandemic, while also providing a better platform to pass legislation on areas such as immigration, trade and healthcare, for instance. Under such a scenario, we think that we would see a further rally in high risk currencies and a modest move lower in the dollar against most of its major peers as investors begin pricing in larger fiscal support and higher corporate taxes.

Should the Democrats fall short of obtaining both Senate seats in Georgia, then we would likely see the opposite reaction in markets, a modest move higher in the greenback and a slight sell-off in risk assets, notably emerging markets currencies. Given that this is the most likely scenario, we think that the moves would be more limited than under a Democrat clean sweep. With Congress split, the chances of deadlock in the US government would increase, making it much more difficult for Biden to pass a substantial fiscal recovery package in order to support the US economy during the pandemic.

🎙 Don’t miss our last FX Talk episode for the latest market news