US dollar retreats amid ongoing pandemic concerns

( 3 min )

- Go back to blog home

- Latest

Risk assets worldwide had a mixed performance last week.

Emerging market currencies are also beginning to reflect the relative performance of different countries in coming to grips with the pandemic. The Brazilian real and the Mexican peso were the worst-performing major currencies of the week, while the Chilean peso and the Chinese yuan ended up near the top of the rankings.

This week, the focus will squarely on the COVID figures out of the US and the European Union summit later in the week (Friday-Saturday). As new cases in the US continue to print daily records while deaths and hospital utilisation play catch up, we think that a likely positive outcome of the EU summit could well energise the euro.

GBP

Sterling had a good week, in spite of the lack of any visible progress in the Brexit negotiations. The credit for the rally probably goes to positive noises about a more generous fiscal stance in the Chancellor’s mini-budget last Wednesday.

This week is data rich in the UK, with releases on GDP (Tuesday), inflation (Wednesday) and the labour market (Thursday). There is scope for the rebound in all of these to surprise to the upside, in line with recent data elsewhere, so we expect the pound to follow the euro higher against the US dollar. Aside from that, investors will continue to pay close attention to the latest virus numbers for any signs that the recent easing in lockdown measures is having an impact on pushing up infections.

EUR

There was little data out of the Eurozone last week, but the euro was generally well supported by optimism about the approval of the EU recovery fund. Angela Merkel seems to be resolved to overcome opposition from the so-called ‘Frugal Four’ (Austria, Denmark, the Netherlands and Sweden) and get the plan approved no later than the European Union summit this week.

The ECB meeting on Thursday is unlikely to see any significant changes in the central bank’s extremely easy monetary policy. President Lagarde is likely to instead use this week’s meeting as an opportunity to again pressure European authorities to do more to support the bloc’s economy. That being said, we expect a positive outcome from the EU summit to keep the common currency well supported against the US dollar.

USD

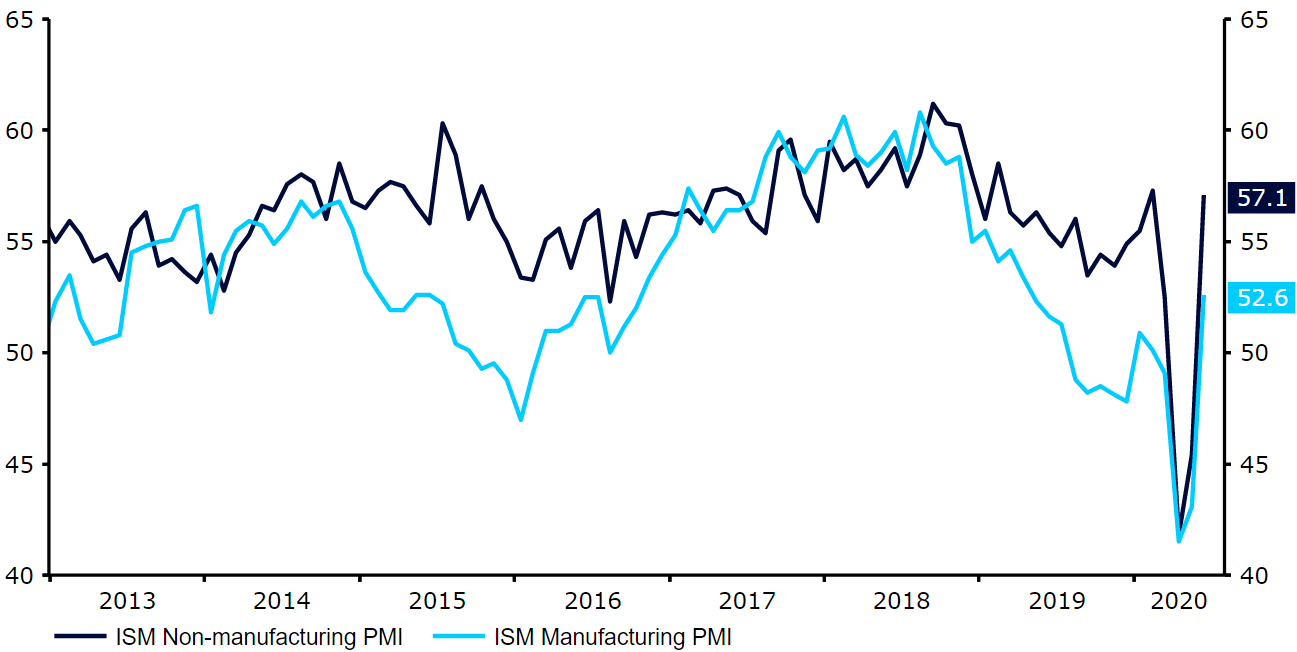

The dichotomy between dismal daily COVID data in the US and comparatively stronger economic data in the US has yet to resolve itself. We are slightly less positive than we were last week. Daily new cases continue to hit record highs. The one silver lining we noted last week is fading, as daily deaths start to climb and catch up with the former. On the positive side we still see positive surprises in economic numbers. Last week it was the jump in ISM non-manufacturing PMI (the rough equivalent of the European PMIs) and a decent drop in weekly jobless claims. However, neither of those reflect yet the reimposition of lockdown measures over the last few days.

Figure 1: US ISM Non-manufacturing PMI (2013 – 2020)

Source: Refinitiv Datastream Date: 13/07/2020

This week we think inflation numbers will be more important than the market does. So far, supply disruptions have not resulted in any inflationary pressures, in spite of the successful income-supporting measures enacted by the Federal government. It will be interesting to see whether that’s still the case four months into the pandemic.