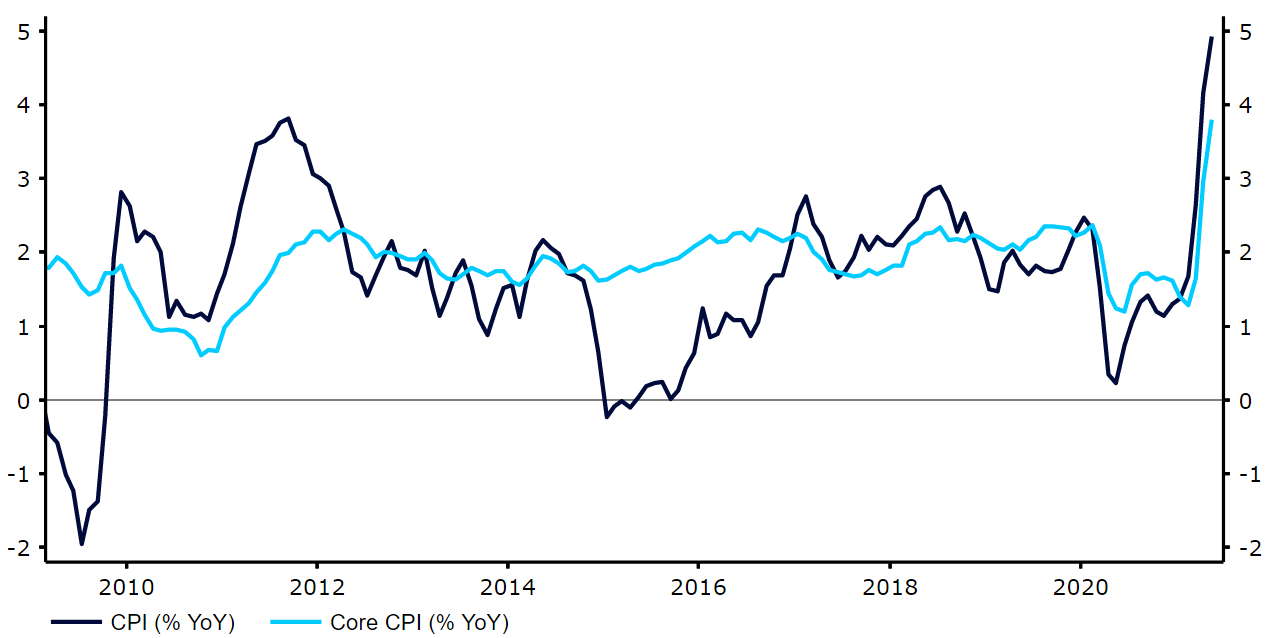

US inflation surges to fresh 2008 highs in May

( 4 min )

- Go back to blog home

- Latest

Thursday was an eventful day for the FX market but, somewhat surprisingly, most of the major currencies ended London trading not too far from where they began it.

Federal Reserve officials will meet next Wednesday and some serious conversations will need to be had around the latest surge in US prices. FOMC members have so far largely taken a relaxed view on the situation, insisting that above target inflation will prove temporary. The longer the situation persists, however, the more uncomfortable policymakers will become and the greater the chances that they’ll take action in an attempt to rectify the situation. Regardless, we expect the Fed to revise higher its growth and inflation forecasts next at its policy meeting week. Of even greater importance to the market will be the updated ‘dot plot’, which shows where Fed members see rates over the next few years. We expect the median dot to be upgraded to show hikes before the end of 2023.

Figure 1: US Inflation Rate (2009 – 2021)

Source: Refinitiv Datastream Date: 11/06/2021

ECB upgrades growth and inflation forecasts

Meanwhile, Thursday’s ECB meeting didn’t trigger too much volatility in the EUR/USD pair, although it was far from a non-event. The balance of risks was upgraded from ‘tilted to the downside’ to ‘broadly balanced’ in light of the recent improvements in the health crisis and the reopening of economies across the European continent. Policymakers are also said to be more optimistic on the Euro Area outlook than at the March meeting, with growth and inflation forecasts for 2021 and 2022 all upgraded. Headline inflation is now expected to rise to 1.9% this year from the previous 1.5% projection. Read our EBC meeting reaction here.

Despite its upbeat assessment on the outlook, the ECB remained committed to its accelerated pace of asset purchases announced earlier in the year. Investors were also left none the wiser as to whether the bank believes that a tapering in asset purchases will soon be required, and there was no word on whether the PEPP may need to be extended beyond March 2022. We think that decisions on both are being punted to the September meeting. Given our expectations that inflation will continue to surprise to the upside, we expect the September meeting to be key. The hawks in the Council will not remain quiescent for long.