Virus fears slam world markets as volatility returns to currency trading

- Go back to blog home

- Latest

Escalating fears surrounding the coronavirus epidemic and the effect containment measures may have on the world economy sent stock markets worldwide sharply lower last week – the worst weekly sell-off since the crisis of 2008.

Figure 1: S&P 500 and Dow Jones Indices (February 2020)

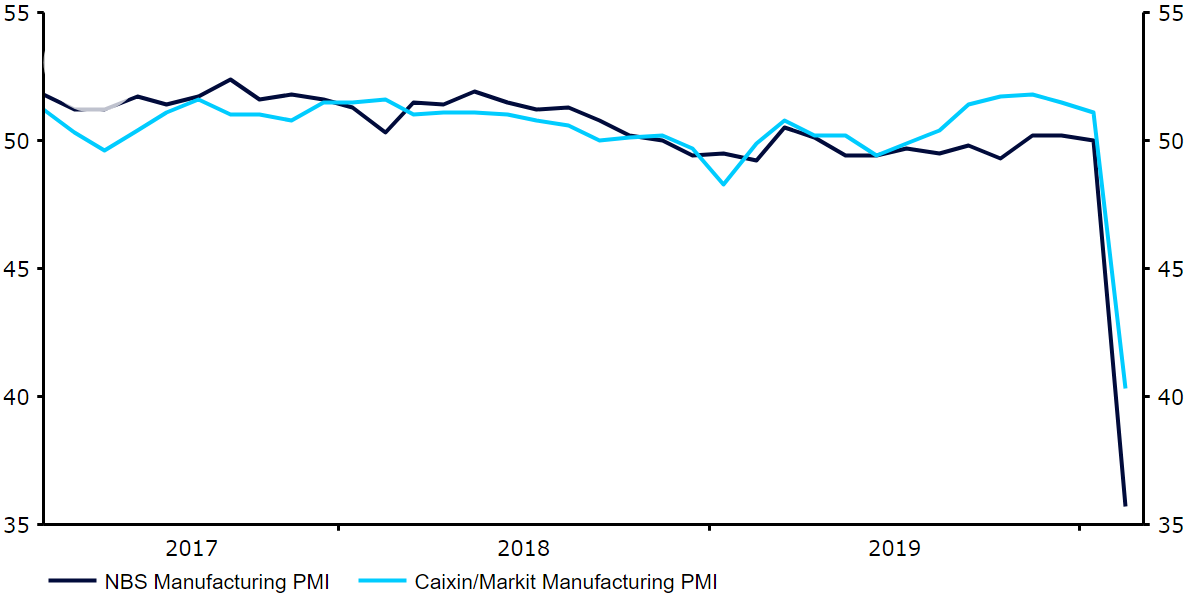

Three factors will drive currency markets this week. First, the daily drip of headlines about the expansion of the virus and any progress in its containment. Second, high-frequency economic data indicating the extent of the contraction in economic activity. Regarding the latter, the Chinese PMIs of economic activity released over the weekend were dire, showing easily the fastest pace of contraction since the data began in 2004 (Figure 2). Third, communication from central banks about the extent of monetary and credit easing markets can expect in response to the crisis. Expect plenty of volatility in markets.

Figure 2: China PMIs (2017 – 2020)

GBP

Sterling was hit last week on two fronts. In addition to the generalised flight from risk caused by pandemic fears, the Johnson government is not scaling back its harsh rhetoric about its willingness to walk away from EU negotiations without a deal.

An additional source of volatility for the pound this month will be the publication of the March budget, which will go ahead as planned on 11th March, despite the recent appointment of Rishi Sunak as the new chancellor. A change in fiscal rules allowing for further fiscal stimulus is a distinct possibility, particularly in the current environment, so we would not be surprised to see the pound rebound against its peers next week.

EUR

The euro outperformance last week was impressive, ending up sharply higher against every major peer, save the Japanese yen. This rebound supports our thesis that its fall to multi-year lows in February owed more to technical dynamics in the market, in particular the use of the euro as a funding currency in so-called “carry trades”, than a deterioration in macroeconomic fundamentals.

Those carry trades are being unwound amid the panic, buoying the common currency. This dynamic is unlikely to change quickly, so the euro should perform in line with risk havens this week. The next key event will be 12th March, when the ECB meets and communicated its reaction to the coronavirus crisis.

USD

Second-tier US data last week was strong but understandably roundly ignored by the markets. Interest rate futures now price in almost four full cuts of 0.25% in response to the crisis, including one at each of the Federal Reserve’s next two meetings. We will be watching closely for any Fed communications confirming or refuting this outlook.

The ISM activity numbers out Monday (manufacturing) and Wednesday (services) may start to show the first impact of the coronavirus supply chain disruptions. However, the usually key US payrolls report for February, out Friday, almost certainly will not, so it will likely be overlooked by the market.