Will the FOMC support the US dollar today?

( 10 min. )

- Go back to blog home

- Latest

Today’s FOMC meeting will arguably be the most signficant event risk in financial markets this week.

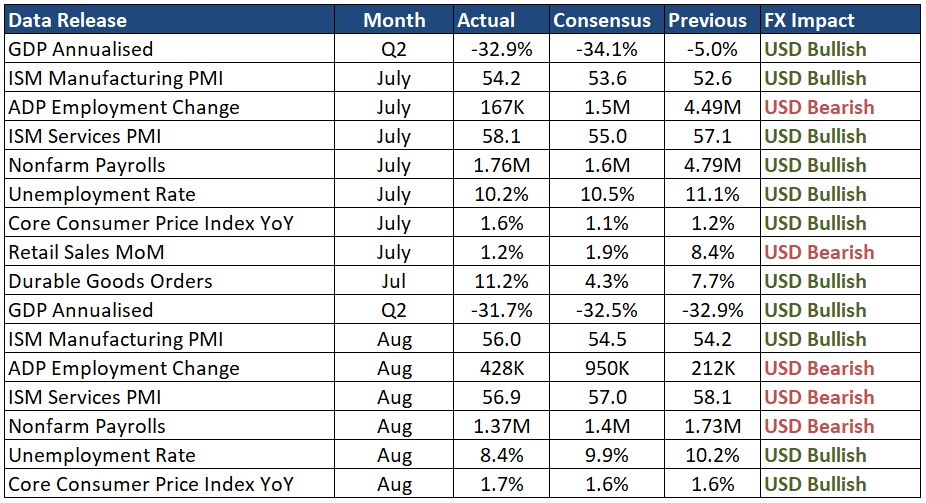

Figure 1: Key US Economic Data Releases (since FOMC’s July meeting)

Arguably of greatest interest to currency markets will be the FOMC participants’ revised interest rate expectations (the bank’s ‘dot plot’). While we think that a handful of participants will forecast hikes for 2023, we think that the adoption of the Fed’s average inflation target will ensure that the medium dot will remain at the 0-0.25% range. A more upbeat-than-expected set of macroeconomic projections and/or a surprise median dot that suggests the return to interest rate hikes in 2023 would support the US dollar this evening. An absence of the latter, combined with comments that keep the door ajar to more unconventional policy easing down the road would, by contrast, likely weigh on the greenback.

Euro edges lower, UK inflation falls to five-year lows

Prior to this evening’s Fed meeting, EUR/USD edged lower yesterday afternoon, in part due to an increase in US stocks and rise in Treasury yields. US data out on Tuesday was also encouraging, with the NY Empire State manufacturing index leaping to a much better-than-expected 17 after investors had eyed a reading of 6. This has been helped by relatively low levels of virus infection in New York. Earlier in the day, the Euro Area economic sentiment index from ZEW also beat consensus (73.9 versus 62.8 expected), although this was largely overlooked by investors.

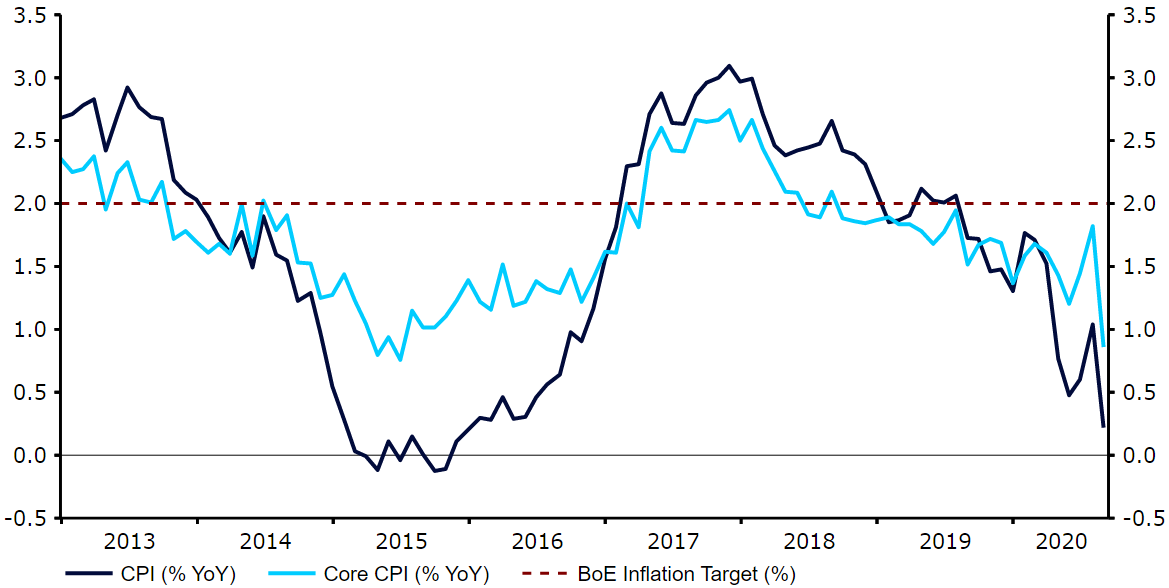

Elsewhere, sterling was able to eke out some modest gains for the second straight day, with no news on Brexit proving good news for the pound. Currency traders overlooked this morning’s sharp decline in UK inflation, which fell to a five-year low 0.2% year-on-year in August (from 1.0%). While such a dramatic drop in prices would ordinarily be sounding alarm bells, the decline was due almost entirely to the government’s ‘Eat Out to Help Out’ scheme, which offered more than 100 million discounted meals in UK restaurants during the month.

Figure 2: UK Inflation Rate (2013 – 2020)

Source: Refinitiv Datastream Date: 16/09/2020

Attention in the UK now shifts to tomorrow’s Bank of England meeting, which you can hear our thoughts on in this week’s episode of FX Talk.