Dollar sells off as central bank responses start to show effects

( 3 min read )

- Go back to blog home

- Latest

World currencies rallied against the dollar last week as a number of hard hit markets showed signs of stabilisation, particularly oil.

The focus this week will be squarely on the US payrolls report for April, out on Friday afternoon. This data will allow us to gauge precisely the damaged wrought on the US labour market by the pandemic, after a series of dismal but perhaps less accurate weekly jobs reports. The other key question will be to see whether the rally in risk assets has got ahead of itself, given the dreadfulness of the economic data so far.

GBP

Soft retail sales data out of the UK did little to move sterling last week, which mostly tracked closely the euro moves against the dollar.

The main event this week is the Bank of England meeting on Thursday, where the MPC is universally expected to hold rates at the de facto zero bound. The market will be looking to the minutes of the meeting to measure members expectations for the depth of the economic contraction. Beyond that, further details on PM Johnsons’ plans to reopen the economy gradually after 7th May will be key.

EUR

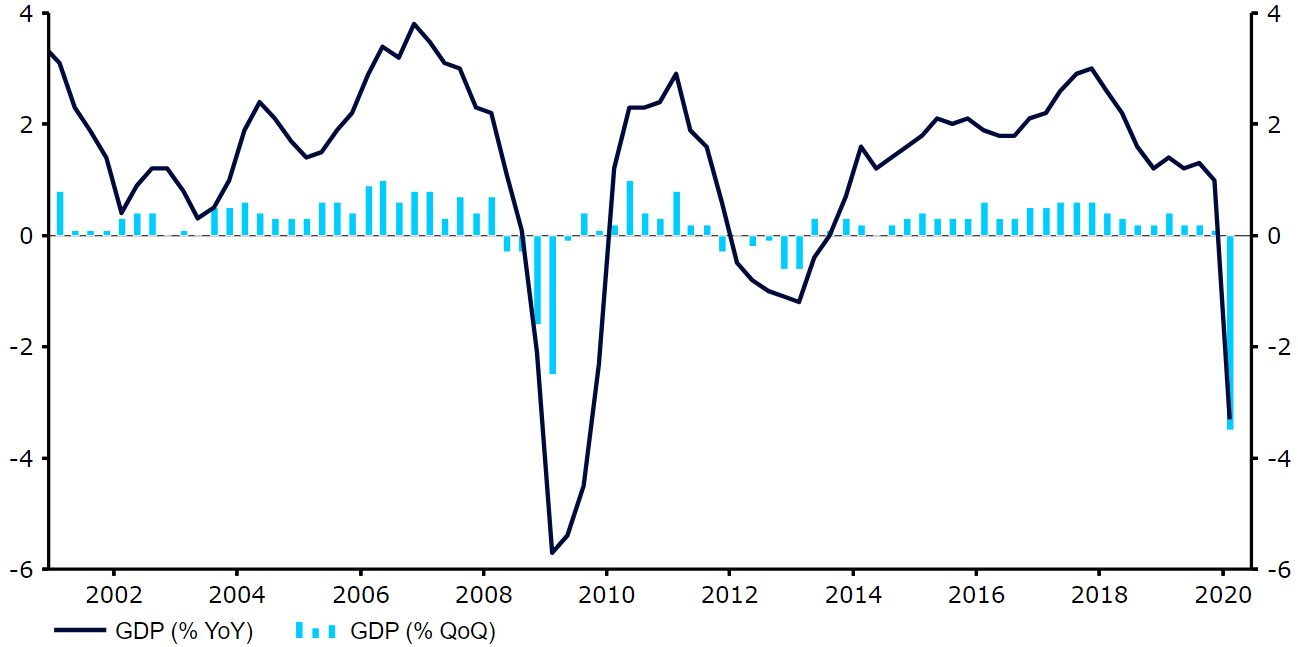

Eurozone economic growth in the first quarter came out at a truly dismal -3.8% quarter-on-quarter, showing a slump of more than three times the size of its equivalent in the US. We think this is mostly due to the late timing of the US confinement orders relative to Europe during the month of March, and expect that the gap will close in the second quarter. The good news is that unemployment ticked up only slightly, as various state schemes to support employment in spite of low activity kicked in.

Figure 1: Euro Area GDP Growth Rate (2000 – 2020)

Source: Refinitiv Datastream Date: 04/05/2020

The ECB announced even more generous financing conditions for banks in the TLTRO III programme and new non-targeted operations, PELTROs, which will kick-off this month. The euro put in a surprisingly good performance, and it seems the market is coming around to our view that the programmes put in place by the ECB are sufficient to ensure no systemic euro risks arise while individual states deal with the crisis.

USD

The U.S. Federal Reserve announced some tweaks to its recently announced lending programmes, and Chair Powell committed to keeping extraordinary measures in place as long as necessary. Aside from that, however, no market-moving news came out of the Fed meeting last week.

We now turn our attention to Friday’s payrolls report, which is expected to show eye-popping jumps in job loss and unemployment. We are more negative than the consensus, expecting a 20% number reflecting the brutal losses in jobs over the past few weeks. With attention now shifting to reopening plans for the different economies, the stubbornly high contagion and death numbers out of the US lead us to expect that the US rebound will lag the Eurozone, putting a floor under the euro.