Falling pound hammers purchasing power of UK expat pensioners

- Go back to blog home

- Latest

- Diminished status of sterling means many expat pensioners suffering from a lower standard of living during retirement

- Weaker currency diminishing income and exacerbating global cost-of-living and inflationary pressures for the 600,000 overseas pensioners

- Uncompetitive FX rates and excessive payment fees add to risk of further hardship as Ebury urges administrators and schemes to do all they can for this community

Analysis from Ebury finds that the falling pound is exacerbating the cost-of-living crisis for UK expat pensioners relying on their fixed income.

Between September 2015 and September 2022, the UK experienced significant political and economic volatility – starting from the struggle to push through an orderly exit from the European Union to the pandemic and consequent inflation shock.

Hit by these headwinds, sterling has struggled against its major peers over the past seven years meaning pensioners living abroad on fixed incomes, like an annuity, paid in local currency have lost out significantly compared to those in the UK.

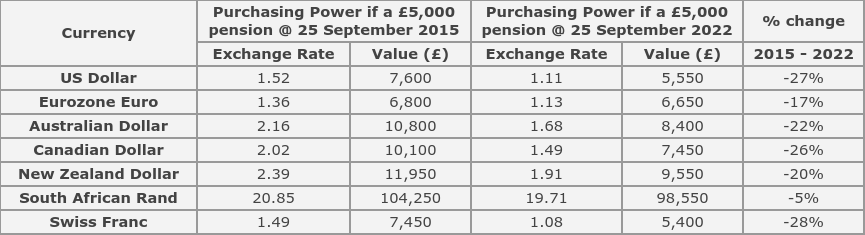

The analysis found that pensioners in the Eurozone would have seen the purchasing power of their pension fall by 17%. Following significant gains posted by the USD in 2022, pensioners being paid in US dollars would now be 27% worse off and that’s before you add in inflation which is currently around 8% in the US, 9% in the Eurozone and 10% in the UK (as of August 2022).

Other currencies have also posted significant gains against the pound including the Australian Dollar (-22%) and the Canadian Dollar (-26%). Pensioners in these countries are also squeezed by frozen State Pension rates which do not benefit from the triple lock or any incremental increase.

The latest estimates suggest that over 600,000 UK pensioners living abroad will be impacted by the movement of the pound against their local currency. The fall in the currency is exacerbated by global inflationary pressures, which are further squeezing budgets.

Owain Walters, Managing Director of Ebury Mass Payments, said the data demonstrated the need for pension schemes and administrators to ensure they are taking every step to mitigate the impact of unfavourable trends in the pound’s value for overseas pensioners.

“Expat pensioners have long been vulnerable to movements in currency markets. Unfortunately, for those moving away from the UK for their dream retirement abroad, the drop in the value of the pound on the back of the recent political and economic turmoil will significantly decrease their living standards.

Strong communication from schemes and employers around the financial dangers and impact of retiring abroad is a necessary first step. This is particularly relevant as the headline exchange rate many pensioners assume they can access is not always an accurate indication of the total cost of making these international payments.

Administrators and pension funds must also ensure they are delivering a best-in-class service for all of their members, including those living overseas. This involves ensuring that they are receiving the very best available FX rates, minimising fees and bank deductions and using technology to process payments in the most efficient way possible.”