Gulf Currencies Market Update – June 2021

( 17 min. )

- Go back to blog home

- Latest

The COVID-19 pandemic has presented a challenging period for the gulf currencies, particularly following the slump in oil prices at the start of the crisis.

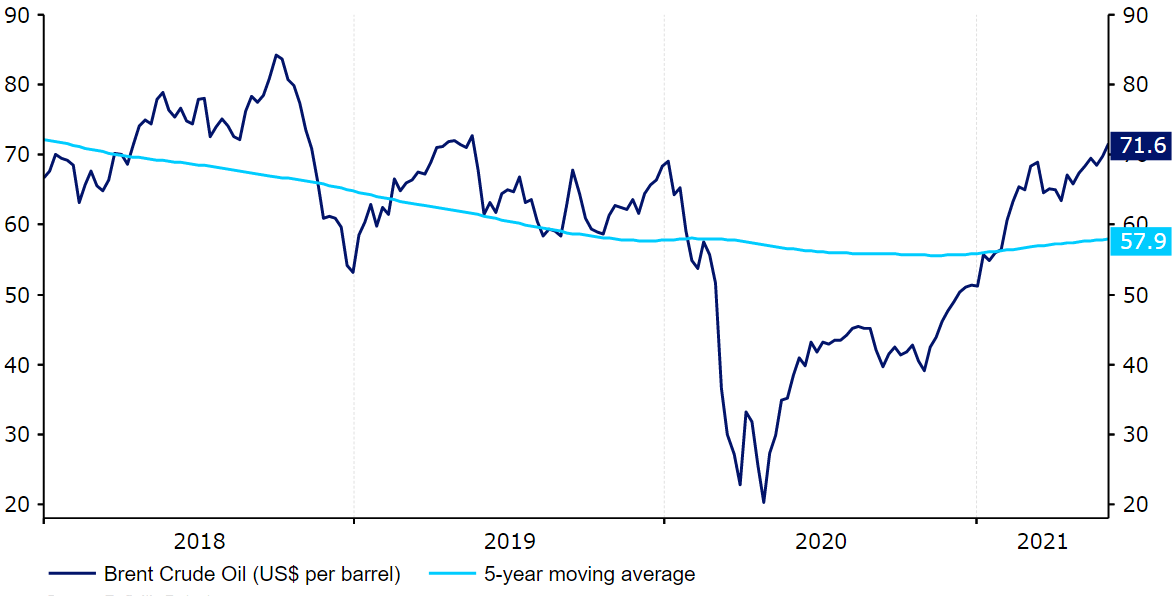

The situation has taken a dramatic turn for the better since then. The rapid rollout of the various COVID-19 vaccines around the world fuelled hopes of a swift recovery in the global economy and has contributed to the sharp uptrend in oil prices – Brent crude oil futures are now back up to around $70 a barrel at the time of writing. While this remains below the breakeven oil price for some GCC nations, the minimum price required for spending needs to be met while balancing its state budget, pressure on the pegs has dramatically lessened. We now see little to no risk at all that any of them will be abandoned any time soon.

Figure 1: Global Brent Crude Oil Futures (2018 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

We have outlined in this report our view as to the vulnerability of each peg to devaluation. We believe that this vulnerability depends heavily on both the ability of the country’s central bank to defend the peg and also the suitability of the exchange rate for each country’s domestic economy. The key factors that we look at in considering each currency’s vulnerability are:

- Foreign exchange reserves & sovereign funds in relation to imports.

- Current account balance as a percentage of GDP.

- Public debt levels as a percentage of GDP.

We have listed in the table below the above variables for the pegged currencies in the gulf region and the forward discount for each currency. The latter represents the magnitude of devaluation expected by the market and combines to give us a decent indication as to the likelihood of devaluation. As you can see, these forward discounts have declined fairly markedly for most currencies since the peak of the market panic in April 2020, particularly in the case of the Omani riyal, suggesting that pressure on the pegs has considerably lessened.

| SAD | UAE | Qatar | Oman | Bahrain | Kuwait | |

| Spot Exchange Rate vs. USD | 3.75 | 3.67 | 3.69 | 0.38 | 0.38 | 0.30 |

| FX Reserves (US$ billions) | 449 | 105 | 55.6 | 17.4 | 3.2 | 44.5 |

| Sovereign Funds (US$ billions) | 900 | 1363 | 345 | 14.3 | 18.6 | 534 |

| FX reserves and sovereign funds as total months’ worth of imports | 42 | 83 | 166 | 14 | 10 | 85 |

| Current Account Balance (% of GDP) [2020] | -2.8% | +5.9% | -2.5% | -5.2% | -2.1%* | +0.8% |

| Public Debt (% of GDP) | 32.5% | 36.9% | 71.8% | 55.9% | 128.3% | 11.5% |

| 1 Year Forward (28/05/21) | 3.7525 | 3.6735 | 3.7064 | 0.3860 | 0.3786 | 0.3031 |

| Forward Discount (28/05/21) | -0.06% | -0.02% | -0.21% | -0.29% | -0.45% | -0.90% |

| Forward Discount (23/04/20) | -0.68% | -0.22% | -0.18% | -5.18% | -0.15% | -1.74% |

| Likelihood of Devaluation | Very Low | Very Low | Very Low | Low | Low | Very Low |

*as of 2019

We have outlined below the rationale for our assigned evaluation likelihoods for each of the six currencies in the GCC. We have also included our latest forecasts for both the Egyptian pound and Turkish lira, two nations that have close ties with the economies in the GCC.

Saudi Arabian Riyal (SAR)

Saudia Arabia is one of the world’s largest oil producers. The sharp downturn experienced in oil prices at the beginning of the COVID-19 crisis was, therefore, particularly bad news for the heavily oil-reliant Saudi economy.

Oil revenues account for around 75% of Saudi Arabia’s total export revenue and 40% of overall output. The country’s oil revenues unsurprisingly declined sharply in 2020, contributing to the record contraction in economic activity experienced in the country in Q2 of last year. Activity rebounded in the second half of the year as virus restrictions were eased and oil prices picked up. Saudi Arabia has done remarkably well in suppressing rates of virus contagion following the initial peak in June last year. The country is also so far making steady progress towards building up immunity levels through vaccinations, having now administered more than 40 doses per 100 people at the time of writing. This provides reason for optimism that we’ll see a return to near-normal economic capacity in Saudi Arabia later in the year.

Despite the aforementioned rebound late-last year, real oil GDP still ended 2020 6.7% lower than where it began the year. This downturn in oil revenues plunged the economy deep into recession and has accelerated the need to diversify away from oil production. GDP fell by another 0.1% quarter-on-quarter in Q1, leading to the seventh consecutive quarter of negative annual growth (-3.3%). Oil GDP collapsed by 12% YoY in the first quarter, in large part a result of production cuts by the OPEC countries since May 2020.

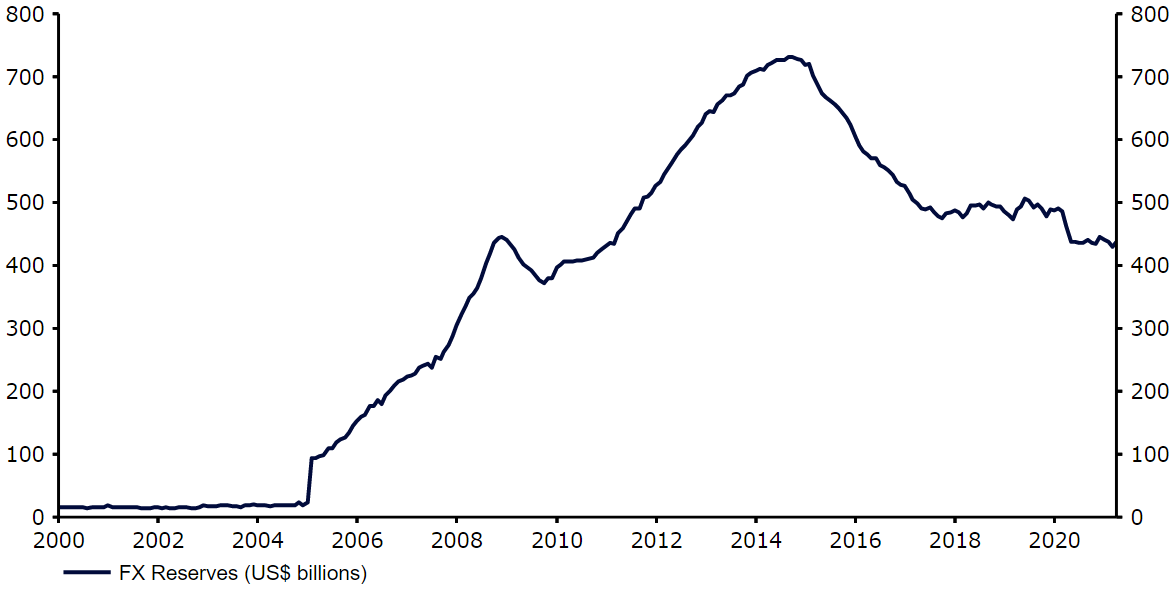

The rebound in global oil prices has, however, significantly lessened pressure on the USD/SAR peg, which came under unwanted speculative pressure in mid-2020 at the height of the downturn. Brent crude oil prices increased to $70 a barrel in May, just shy of its highest level since May 2019. While this remains short of Saudi Arabia’s reported breakeven oil price for this year, which is estimated to be around $76 a barrel, we think that the riyal’s peg is under little risk of being abandoned any time soon. Saudi Arabia amassed huge amounts of oil wealth during the periods of high oil prices and its FX reserves are now among the largest in the world. Saudi Arabia’s sovereign funds, a de facto FX reserves, are also massive at approximately US$900 billion. Combined, these total the equivalent of around 42 months’ worth of import cover – more than enough for continued intervention.

Figure 2: Saudi Arabia Foreign Exchange Reserves (US$ billions) (2002 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

The Saudi Arabian Monetary Agency (SAMA) reaffirmed its commitment to maintaining the peg during the peak of the speculative pressure in May 2020. During a press conference it noted “SAMA remains committed to maintaining the exchange rate at the official rate of 3.75 riyals to the dollar as an anchor of monetary and financial stability”. We think the ample FX reserves should be more than sufficient for the SAMA to continue to intervene in order to maintain the existing peg for the foreseeable future.

United Arab Emirates Dirham (AED)

The UAE dirham is not vulnerable to a devaluation, in our view, and is indeed one of the best equipped in the GCC to maintain its peg.

Similarly to many of its regional peers, the UAE is also fairly reliant on oil production as a share of overall output. The UAE’s GDP collapsed by 5.8% in 2020, a product of both the downturn in oil revenues and a loss of tourism receipts. The country’s central bank expects growth to return in 2021, with activity set to expand by 2.5% this year and 3.5% in 2022.

We have been particularly encouraged by the country’s vaccination efforts so far, which has seen the country administer approximately 135 vaccine doses per 100 people at the time of writing – among the highest in the world. This, in our view, should allow a swift return to near-normal economic capacity in the second half of the year. The Dubai Expo world fair and Fifa World Cup in neighbouring Qatar should further help support economic growth over the central bank’s forecast horizon. The UAE is also one of the most diversified economies in the GCC, so the collapse in oil prices at the start of the COVID-19 pandemic was not quite as damaging to the domestic economy as witnessed elsewhere in the region.

We think that the Central Bank of the UAE should have little issue maintaining the existing USD peg. Hard currency foreign exchange reserves are relatively low at around $105 billion, but the UAE stores wealth in other areas including sovereign wealth funds of more than $1360 billion (a combined 83 months’ worth of import cover). This is second only to China’s as the largest sovereign wealth fund in the world and should provide plenty of room for the central bank to continue intervening in the currency market for a long while yet.

An increase in government debt as a share of GDP to 36.9% in 2020 is not ideal, but the country’s current account remains firmly in positive territory at 5.9% of GDP last year. The latter should help warn off any speculative attacks against the currency during future periods of market uncertainty. We also don’t expect this surplus to be eroded any time soon. Global oil prices would need to average around $30 a barrel over a one-year period for this to be the case, which appears highly unlikely for the foreseeable future.

Figure 3: UAE Current Account Balance [% of GDP] (2002 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

Official communications from the central bank on the suitability of the peg have been scarce since the bank affirmed its commitment to protecting it in March last year, although we don’t think that such communications have been particularly necessary. The currency’s one-year forward discount rate peaked at around -0.2% at the height of the pandemic, suggesting that speculative pressure on the currency in the past year or so has been relatively modest.

Qatari Riyal (QAR)

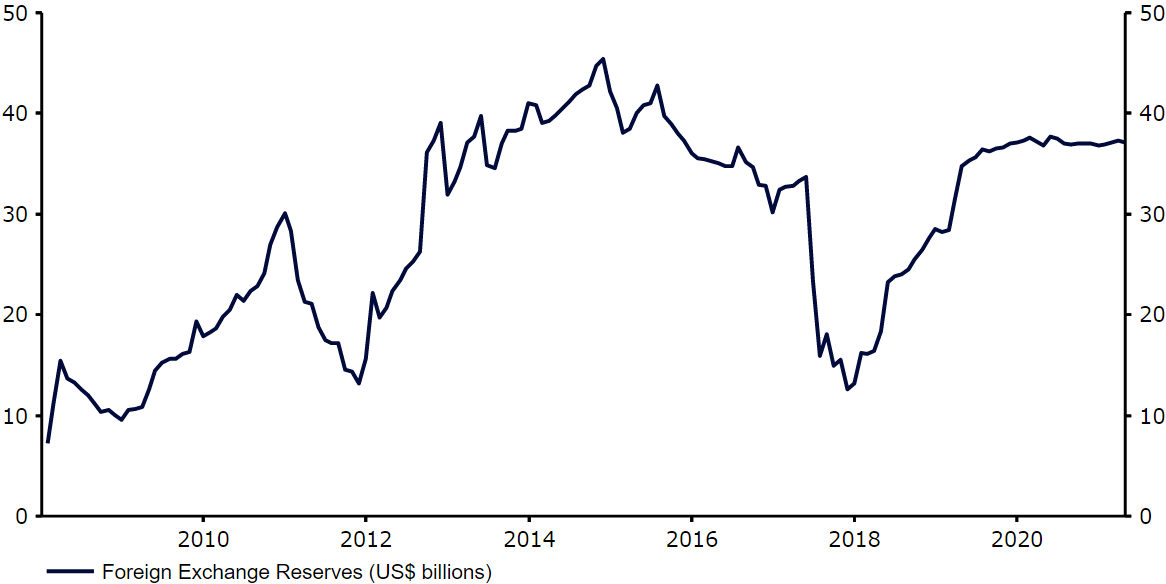

We think Qatar is one of the best placed countries in the GCC to deal with any potential speculative attack on the currency’s peg.

Foreign exchange reserves are vast and in excess of US$55 billion (Figure 4), while the Qatar Investment Authority’s sovereign funds are also huge and have grown significantly in the past few years to a mammoth $345 billion. This equates to nearly 14 years’ worth of import cover, which is more than enough for the central bank to continue intervening in the currency market in order to protect the peg for the long-term future.

Figure 4: Qatar Foreign Exchange Reserves (2007 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

Qatar also continues to run a positive balance of trade and current account. The current account fell in 2020 to 2.3% of GDP, although this was due to the COVID-19 pandemic and we expect this to prove temporary with a larger surplus likely over the coming few years. The balance of trade has already picked up sharply and is now back around early-2020 levels. Public debt is relatively high at 72% of GDP, but an analysis of the one-year forward exchange rate suggests that there has been almost no real speculative pressure on the riyal since the start of the pandemic, and investors appear highly confident that the peg will hold.

Indeed, the Qatari riyal was the only currency in the GCC to not come under speculative pressure at the height of the market panic in 2020, with Qatar’s government bonds outperforming the five other countries in the bloc. We think that this will remain the case for the foreseeable future, in large part due to the country’s strong external position and massive sovereign wealth fund.

Omani Riyal (OMR)

We think the risk of devaluation in the Omani riyal is the highest among all the GCC nations, albeit still low.

In comparison to its peers, FX reserves held at the Central Bank of Oman are relatively modest at the equivalent of just 7.5 months’ worth of import cover. Oman has the largest current account deficit of all the nations covered in this report. The deficit has narrowed in the past few years from more than 18% of GDP to 5.2%, although it still remains rather large, particularly compared to most of its peers. In order to balance both the fiscal and external accounts in Oman, oil prices would also need to increase to a projected $80 a barrel. This is a higher break even level than most other gulf nations.

Given the above, speculative pressure on OMR has been the highest of the GCC nations during the pandemic period. The USD/OMR one-year forward rate surged to its highest ever level in April 2020 (around the 0.405 mark), with the forward discount ballooning to more than 5%. Since June last year, speculative pressure on the peg has significantly lessened as oil prices picked up and lockdown restrictions were gradually lifted around the world. This one-year forward rate is now lower than where it was prior to the outbreak of the COVID-19 virus.

To make matters worse, public debt levels have also continued to increase at an aggressive rate as a share of GDP in recent years. This ratio is projected to have risen to more than 80% in 2020 with a high share, approximately three-quarters, expected to be made up of international borrowing.

Figure 5: Oman Government Debt to GDP (2006 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

Despite the aforementioned risks to the peg, authorities have continued to stand by the fixed exchange rate. Secretary General of the Omani Ministry of Finance stated in December 2020 that the peg would continue to be defended in order to prevent a significant increase in inflation. We think that the improving global backdrop should ensure a maintaining of the peg, at least over our forecast horizon.

Bahraini Dinar (BHD)

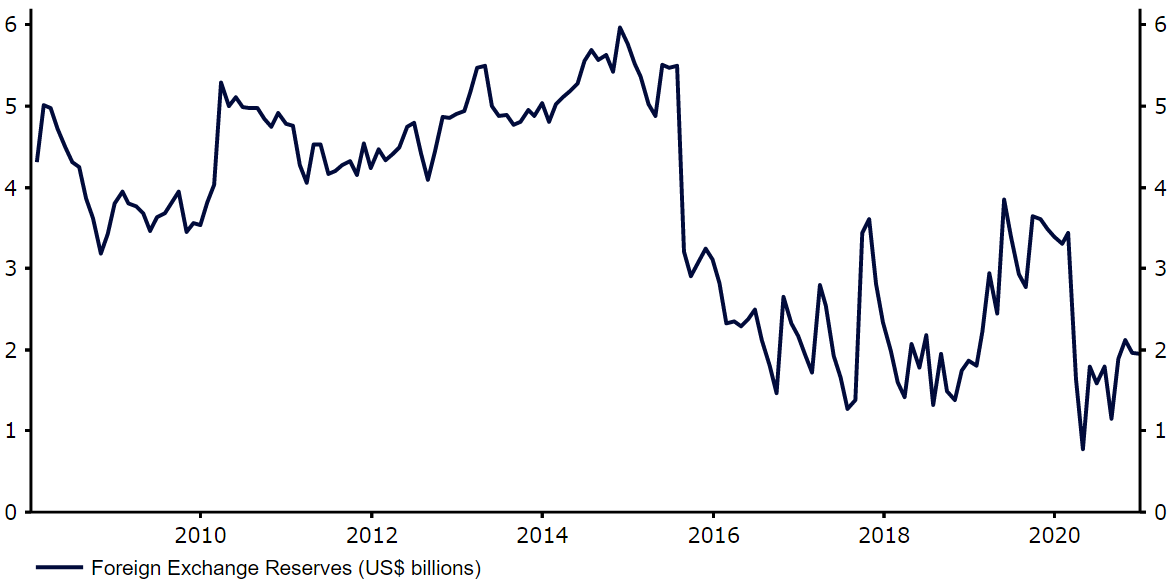

The Bahraini dinar peg against the US dollar was one of the more exposed to devaluation in the GCC during the initial bout of market panic at the start of the COVID-19 crisis in early-2020.

Bahrain lacks the deep financial resources of many of its neighbouring countries. Foreign exchange reserves are fairly limited in comparison and were depleted heavily in the first half of last year as the Central Bank of Bahrain intervened aggressively in order to protect the peg. FX reserves tumbled by approximately 78% between February and April 2020 alone from $3.4 billion to just $772 million, their lowest level since April 1990. Reserves held at the central bank have picked up modestly since then although, at less than $2 billion, remain comfortably shy of where they were prior to the outbreak of the COVID-19 virus.

Figure 6: Bahrain Foreign Exchange Reserves (US$ billions) (2002 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

Ratings agency Moody’s warned that the dinar was at risk of devaluation in July last year, stating that the drop in reserves ‘highlights Bahrain’s exceptionally high external vulnerability risk given that its longstanding exchange-rate peg is supported by only a very thin foreign currency buffer’. We note, however, that similarly to many of its peers, Bahrain’s sovereign funds compensate for much of this shortfall. At approximately $22 billion, the combination of sovereign funds and FX reserves currently equate to around 10 months’ worth of import cover. While not ideal levels, we think that it is a sufficient level for now, particularly given pressure on the GCC currencies has abated substantially in the past year or so.

Rising government debt levels are a concern and a reason to be fearful that the peg may not hold. Government debt as a percentage of GDP has risen above 100%, soaring to 128.1% in 2020 – the largest among the GCC nations. We are also concerned about the country’s current account, which has moved into deficit in recent years (2.1% last year). However, Bahrain is widely believed to be able to count on financial support from oil-rich Saudi Arabia, given the close political ties between the two countries. This could alleviate some pressure on FX reserves, although this may prove no more than a short-term measure. Again, we see little risk of devaluation, albeit we do emphasise that the risk of depegging is higher in Bahrain than most of its peers.

Kuwaiti Dinar (KWD)

Unlike the rest of the countries in the GCC, the Kuwaiti Dinar is no longer pegged to the USD, and is instead pegged against a basket of currencies. The composition of the basket is unknown, although it consists of currencies of Kuwait’s major trade and financial partners.

The decision to move away from the fixed exchange rate against the USD in 2007 came in a bid to control high inflation, which peaked at 12% following the then steep depreciation of the dollar. This seems to have had the desired effect and consumer price growth in the country has remained around a much more manageable 2-3% throughout most of the past few years. The adoption of the basket also means that the trade-weighted value of the currency is markedly less volatile than the rest of its peers. It has also allowed the country to follow a different path of monetary policy than the rest of the GCC central banks, which are forced into changing their benchmark interest rates in tandem with the Federal Reserve.

We think that Kuwait is in a strong position to protect the dinar’s soft peg. The country’s sovereign funds are significant and combined with FX reserves equate to 85 months (around 7 years) worth of import cover. The currency has, however, come under greater speculative pressure than all of its peers, with the exception of the Oman riyal, since the start of the COVID-19 pandemic. Kuwait has been constrained by a law preventing the government from borrowing in order to finance its budget deficit and some investors have suggested devaluation could be required in order to shore up finances. We are, however, of the opinion that this will be avoided and see the passing of a new law permitting borrowing or the raising of taxes as much more likely.

Egyptian Pound (EGP)

The Egyptian pound (EGP) has, since November 2016, been run under a free floating exchange rate, although the country’s central bank, the Central Bank of Egypt (CBE), continues to manage the currency extremely closely against the US dollar.

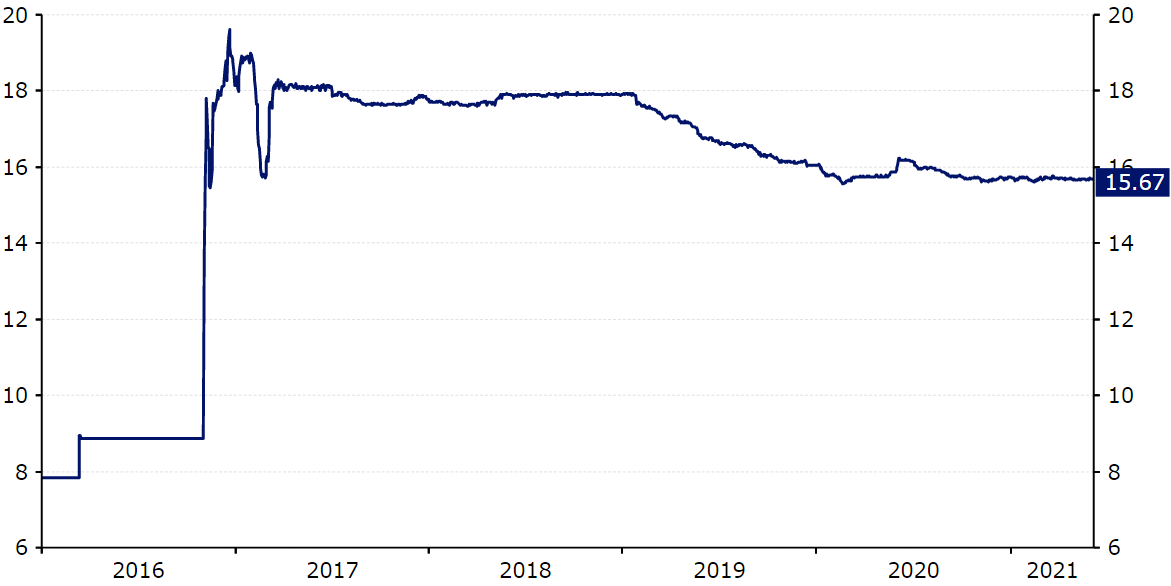

Following a prolonged period of gradual and controlled devaluations, EGP was devalued sharply in November 2016. A shortage of foreign exchange reserves held at the central bank, declining oil prices and a downturn in domestic economic conditions left the Central Bank of Egypt with no choice but to remove the currency’s peg against the US dollar and allow the pound to float freely. This caused EGP to immediately shed around one half of its value and crash to its lowest level on record (Figure 1).

Figure 7: USD/EGP (2016 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

Since then, the central bank has been successful in preventing further devaluations in the currency, barring a brief period of weakness at the start of the COVID-19 crisis, and has engineered a gradual appreciation in the pound versus the US dollar. This ensures that the currency is now trading just shy of its strongest position since the immediate aftermath of the removal of the peg, around the 15.7 level.

We note that even the move lower in EGP during the peak of the COVID-induced sell-off in risk assets was only very minor and contained to around 3.5%. This ensured that the pound was one of the best performing EM currencies in the world in the first half of last year. We attribute this outperformance, and the continued stability in the currency since then, to a general improvement in macroeconomic conditions in the country. Prior to the pandemic, annual growth had returned to around the 5-5.50 level. The Egyptian economy was also one of the few in Africa to post positive growth in 2020, despite the impact of the pandemic, expanding by 3.6%. Growth is expected to remain subdued at around 3% in 2021, in part due to lower tourism receipts, but a return to pre-COVID levels of expansion is expected next year, underpinned by robust domestic consumption.

Since the devaluation in 2016, real interest rates have also picked up sharply, and have remained around +3-5% since the start of last year, providing an appealing proposition to investors. A spike in inflation in 2017 saw real rates tumble to below -16% at one stage. The Central Bank of Egypt subsequently raised interest rates aggressively and was successful in encouraging inflows, alleviating pressure on the currency and reining in prices. With inflation easing the CBE has actually had room to cut interest rates at a fairly aggressive pace, slashing its main base rate again late last year to 8.25%. This gradual move to a more normalised policy environment has been an encouraging development and supportive of the investment environment.

Crucially, foreign exchange reserves held at the central bank have also increased sharply since the devaluation. Reserves increased almost fourfold in the two years from mid-2016, although the central bank did intervene again during the peak of the COVID-19 crisis in early-2020 in order to prop up the currency. Even following this intervention, reserves remain at much more comfortable levels than has been the case in the recent past and are now at the equivalent of just below six months’ worth of import cover. This should provide some room for the CBE to intervene in order to protect the currency over our forecast horizon, if required. The scrapping of a mechanism that guaranteed foreign currency for investors that sell government securities has further helped improve the foreign funding position.

Moreover, Egypt’s current account deficit has also decreased marginally in the past five years from 6.1% of GDP in 2016 to 3.1% last year, albeit the balance of trade has fallen deeper into deficit in recent months. Regardless, we think that Egypt’s strong macroeconomic outlook, high real rates, sufficient FX reserves and declining inflationary pressures continue to lessen speculative pressure on the pound. We therefore continue to forecast gradual gains for EGP against the US dollar over our forecast horizon that would return the currency closer in line with fair value.

| USD/EGP | EUR/EGP | |

| Q3-2021 | 15.35 | |

| E-2021 | 15.00 | |

| Q1-2022 | 14.75 | |

| Q2-2022 | 14.50 | |

| E-2022 | 14.00 |

Turkish Lira (TRY)

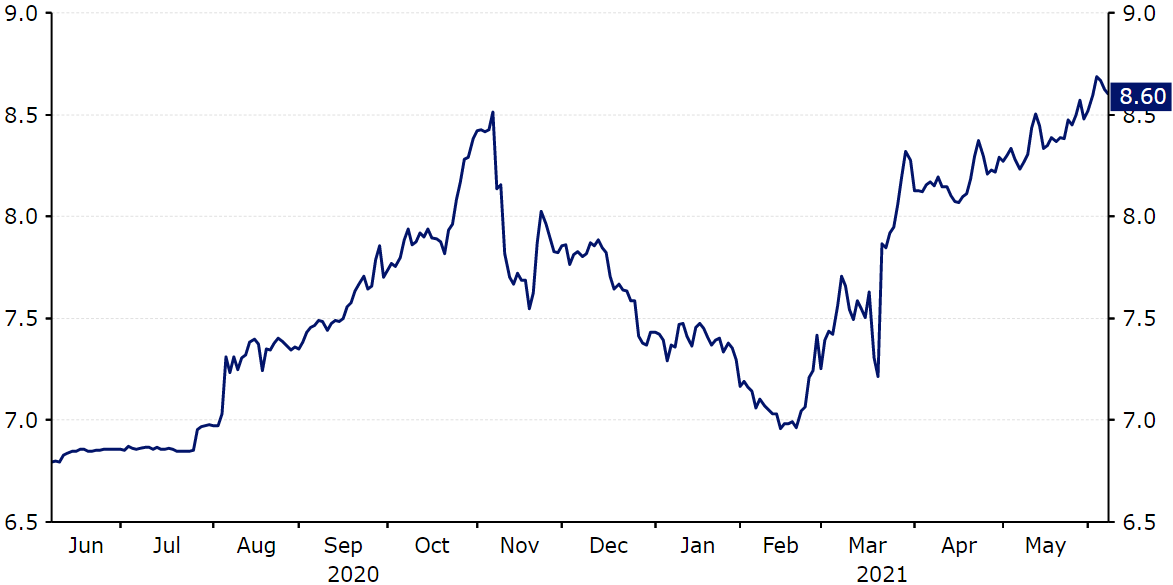

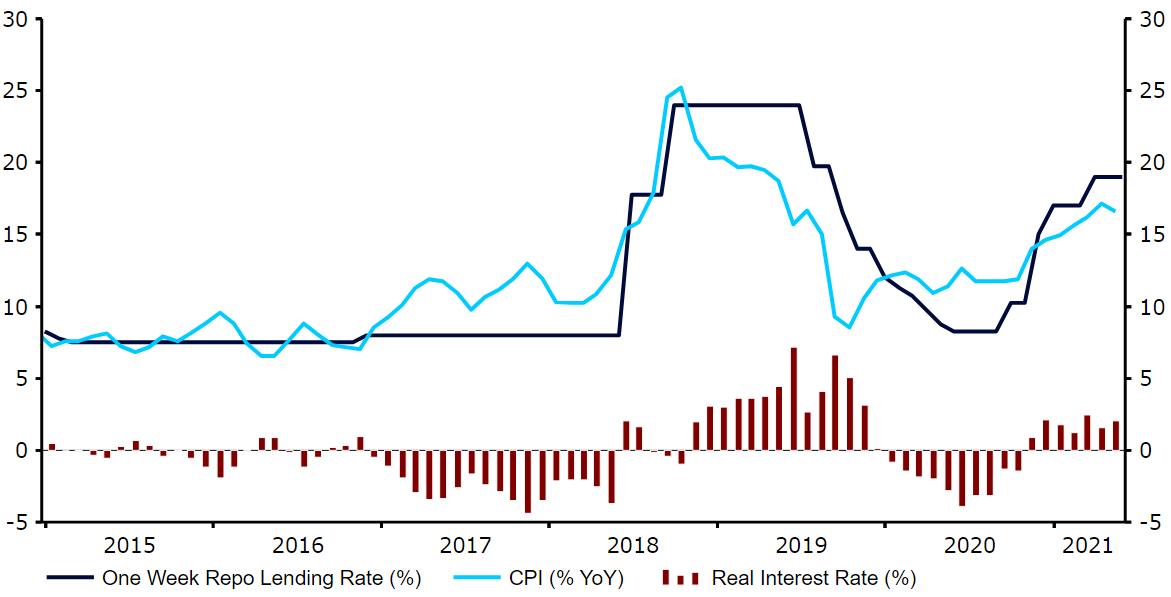

The lira ended last year almost 20% lower versus the US dollar and was the third worst-performing EM currency in the world. The currency recovered some of its losses following a policy shift from the CBRT in November, although it has sold-off again since late-February, first following a worsening in Turkey’s COVID situation and then after the dismissal of CBRT president Naci Ağbal.

Figure 8: USD/TRY (2020 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

One of the key factors that has heightened volatility in the lira has been Turkey’s unorthodox monetary policy stance. Under pressure from President Erdogan, the central bank has largely refrained from tightening monetary policy in recent years, despite high inflation. In November, Turkey signaled to the international community that it was serious about bringing some normality to its policies by making personnel changes. Turkey’s president Erdogan ousted central bank chief Murat Uysal, with finance minister and Erdogan’s son-in-law, Berat Albayrak, quitting soon afterward. Under the next governor’s leadership, Naci Ağbal, the central bank was proactive with interest rate hikes, raising rates to 19%. Ağbal was, however, dismissed in March, triggering another violent sell-off in TRY. His replacement, Şahap Kavcıoğlu, has echoed the president’s critique of high interest rates and has opened the door to cuts in the coming months. Erdogan has recently stated that cuts could begin in July or August, albeit Kavcioglu has since calmed the market.

Turkey was one of the few countries that managed to post growth in 2020, but at 1.8% it was significantly below its long-term average. We’re hopeful that a recovery in domestic consumption will ensue once virus restrictions are lifted in the second half of the year, but restrictions were tightened following a surge in contagion numbers. A full national lockdown was introduced for the first time in late-April, with Oxford University COVID-19 Government Response Stringency index for Turkey rising to its highest level since the onset of the pandemic, albeit restrictions were eased again in May. While this could lead to an underperformance in Turkey’s economy, we have been encouraged by the country’s relatively impressive vaccination rollout that has exceeded most of other EM countries.

Figure 9: Turkey One-week Repo vs. Inflation Rate (2015 – 2021)

Source: Refinitiv Datastream Date: 08/06/2021

While we think that the improving global pandemic situation should be mostly positive for risk assets in general, we believe that the lira will be one of the currencies that will continue trending downwards against the dollar. We think that the shift in CBRT leadership means that Turkey will embark on an easing cycle sooner than previously expected. Turkey’s macroeconomic fundamentals are also weak. The country’s model of growth is, in large part, reliant on external financing, which while largely successful, has created a significant current account deficit that has put pressure on the exchange rate. In times of worsening investor sentiment, this deficit acts to magnify swings in the value of the lira. After a brief period of remaining in positive territory in 2019, the current account turned negative again and equated 5.1% in 2020. External debt is also rather high (57% of GDP), with over half of this denominated in foreign currency. Real rates remain positive, but with inflation rising to around 16-17% we’re likely to see a reversal back into negative territory in the coming months, particularly given the CBRT looks likely to embark on another easing cycle.

Due to a shift in expectations towards CBRT policy and the market’s reaction to Ağbal’s dismissal, we have revised our USD/TRY forecast higher over the entire forecast period and expect the currency to end this year at record low levels, before depreciating further in 2022.

| USD/TRY | EUR/TRY | |

| Q3-2021 | 8.80 | |

| E-2021 | 9.20 | |

| Q1-2022 | 9.40 | |

| Q2-2022 | 9.60 | |

| E-2022 | 10.00 |

👉 Listen to our latest FX Talk episode | S2E9: The G3 central bank meetings are coming. Here’s what our analysts expect: